Attention: Goal-Oriented and Family-Oriented Individuals Who Work Hard To Provide For Their Families...

Pay Attention

Build Your Financial Future and Your Family's Without Breaking The Bank

Everybody's Investment Plan Is To "Just Keep Working," But You'll Have A Better Plan

Watch The Video To Learn More

What The Wealth Building Course Will Cover

and more...

The 12 Step Sequence To Saving

The 4 Essential Investing Principles

The 5 Habits to Avoid To Boost Life Approval Odds

The Policies You Shouldn't Have

Why We Do What We Do?

Our Biggest Priority Has ALWAYS been about the people and families we serve. We were not taught how to be smart with our money, we were taught a system that is not meant to benefit us but corporate America. Very few have learned these lessons and have capitalized on it. You might be wondering why this information isn't being talked about often, but the truth is...IT IS. This information is filtered out thoroughly and to those who DO manage to find it, they disregard it in disbelief.

We Teach Hard-Working and Misinformed individuals regardless of their financial scenario how to start building generational wealth WITHOUT BREAKING THE BANK.

It's Your Money. You Should Be Able To Keep More Of What You Earn.

Who Are These Investment Programs For?

If you are someone who wants guidance in investing and understanding how the market works, learning the principles to be able to invest in yourself and as well as understand what you're actually investing in, these programs are for you.

These are NOT

-Get Rich Quick Schemes: These are exclusive Mutual Funds that offer tax-free growth that matches or exceeds the market.

-Risk-Free investments: Every Investment involves risk, since these plans consist of being invested into portfolio and blue-chip companies there is always the possibility of risk, however you will receive personal financial advisors as part of your program to guide you on what you're invested in as well as 24/7 access to your portfolio to review your account performance so that you can be assured you are receiving the best quality service. There are also a variety of exclusive plans that are available based on goals and risk tolerance (i.e. Low risk, high dividend-yielding funds, etc.)

Immediate Access Funds: The Investment Accounts We Offer as Tax-Free Incentive Accounts are strictly retirement-based accounts that are partnered with exclusive mutual funds that are not accessible to publicly traded platforms but can still be viewed in the stock market. We do have Money Market accounts that mimic most savings accounts from banks but your APY% is much greater which can range from 3-6% and is easily accessible to you. Money Market accounts do not lose money and only gain interest, they do not grow quickly but they are safe and offer quick access to your cash. The interest you will be required to pay taxes on however.

Disclaimer: Every Investment you make no matter what you do and no matter what industry it's made in will always involve risk. There is no such thing as a "Risk-Free" asset/investment. Removing losses and preventing losses is possible but then the risk would be minimized growth.

With that said, our investment strategies are simple and easy to follow while still maintaining healthy expansion of growth.

We Hold Mutual Fund investing and Money Market Accounts as one of the best investment strategies within the life insurance and securities industry there is.

Are there greater return investments available? Of course, there are investment opportunities everywhere such as real estate. However, mutual fund investing offers a steady expansive growth plan with a variety of exclusive mutual funds that are customized to your own specific goals and risk-tolerance. Most banks offer these plans with the requirement that you provide $100,000.00 to invest in order to work with their financial advisors, you don't need that with us. It's much simpler, and way more affordable and you choose your pace. You have full control, we just give you the right vehicles to do it on autopilot.

How Long Would It Take You?

Most People Don't Consider These Questions Until It's Too Late

To Save 1 Million Dollars

To Save 500k Dollars

To Save 300k Dollars

To Fix Your Credit Score to 700+

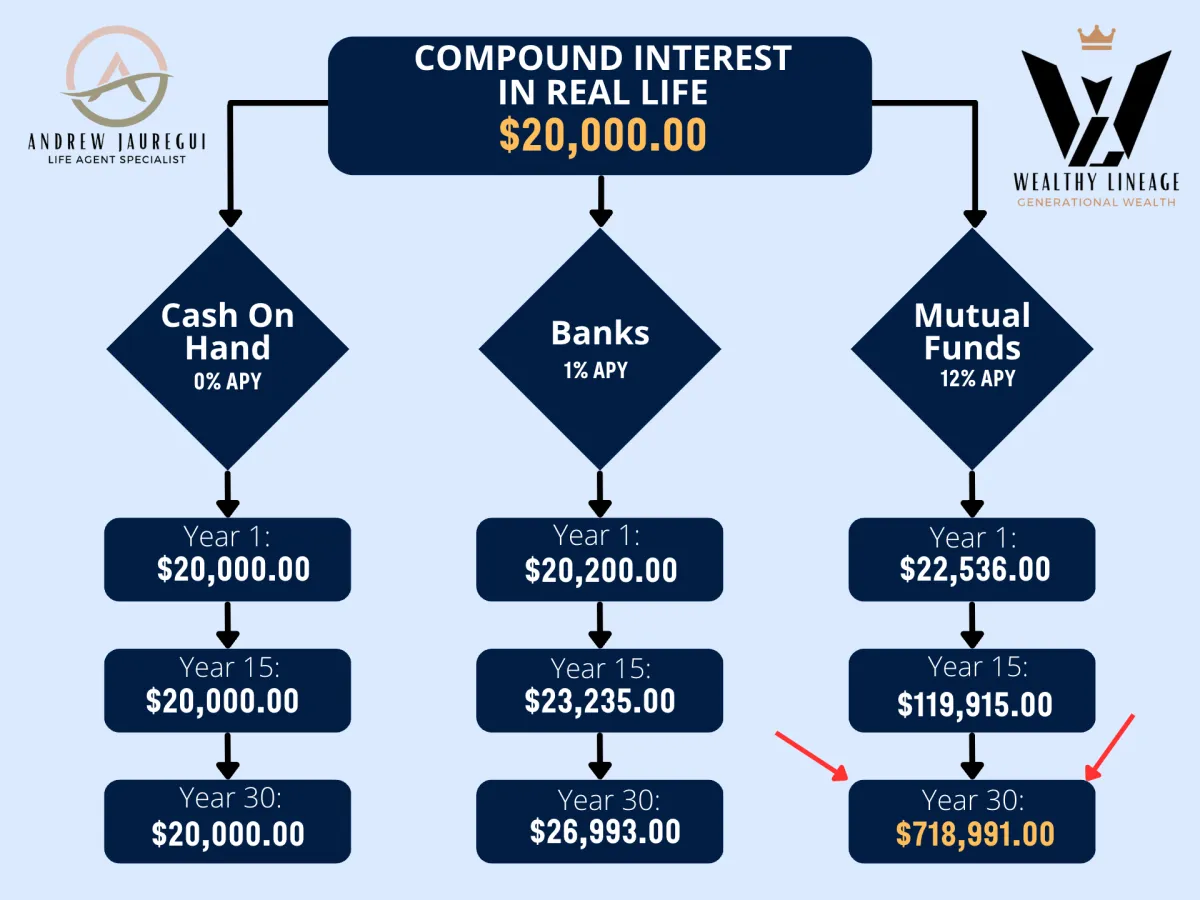

To Grow Your Savings Leaving It in the Bank

To Retire Before the Age of 65?

To Retire Your Family, Your Parents, Your Kids

To Own Your House Instead Of Just Renting

If You Were Getting Discouraged By These Questions, Don't Be Because You're Not Alone!

Our Team Of Professionals

We Have The Most Elite Professionals And Best In The Business To Help You In ALL Your Goals

Our Team Of Professionals includes but are not limited to:

✅Lenders

✅Professional Tax Advisors with an Entrepreneur Mindset

✅Realtors

✅Licensed Financial Advisors

✅Notaries

✅Credit Repair Specialists

✅Life Insurance Specialists

and more...

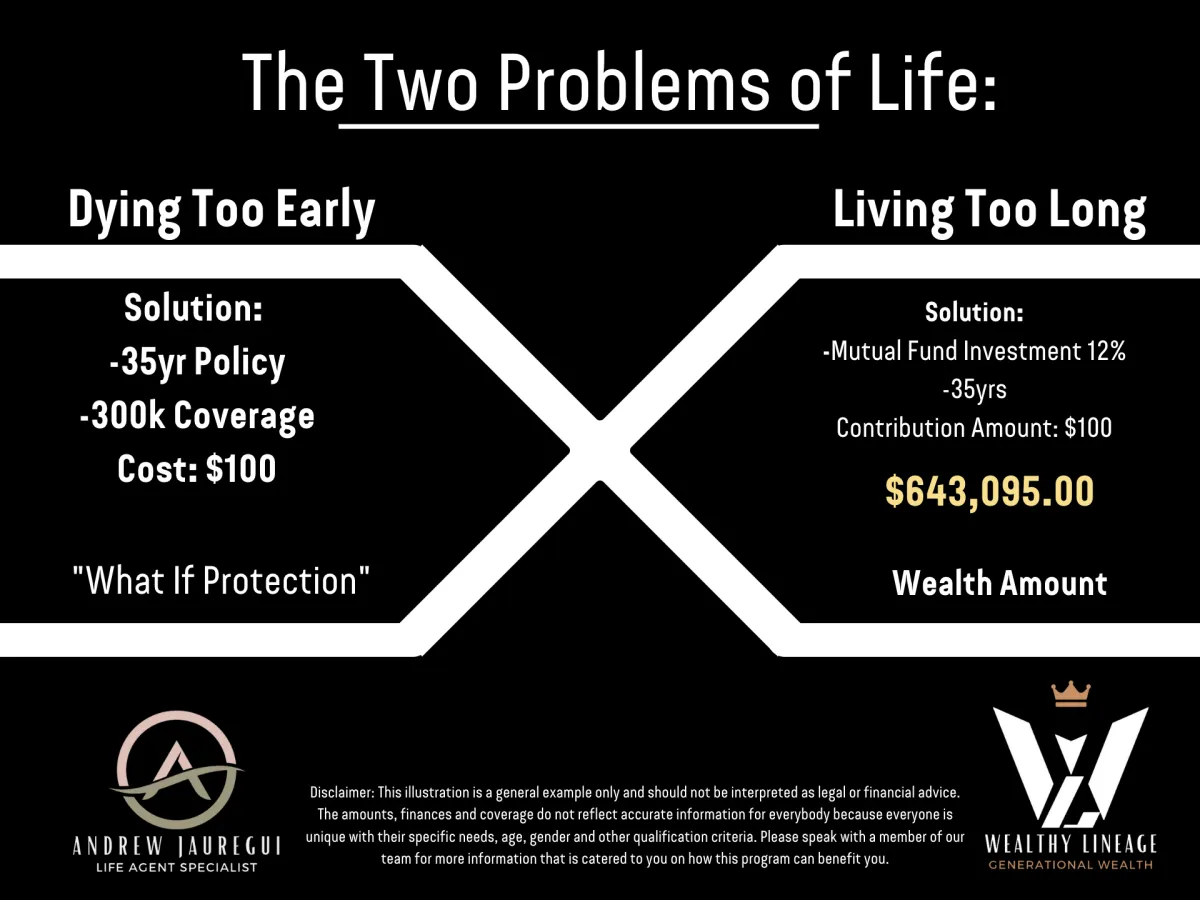

Do You Know The Two Problems Of Life?

👇🏽👇🏽👇🏽

Why Saving Is Losing You Money

Hint: The Banks Don't Want You To know this...

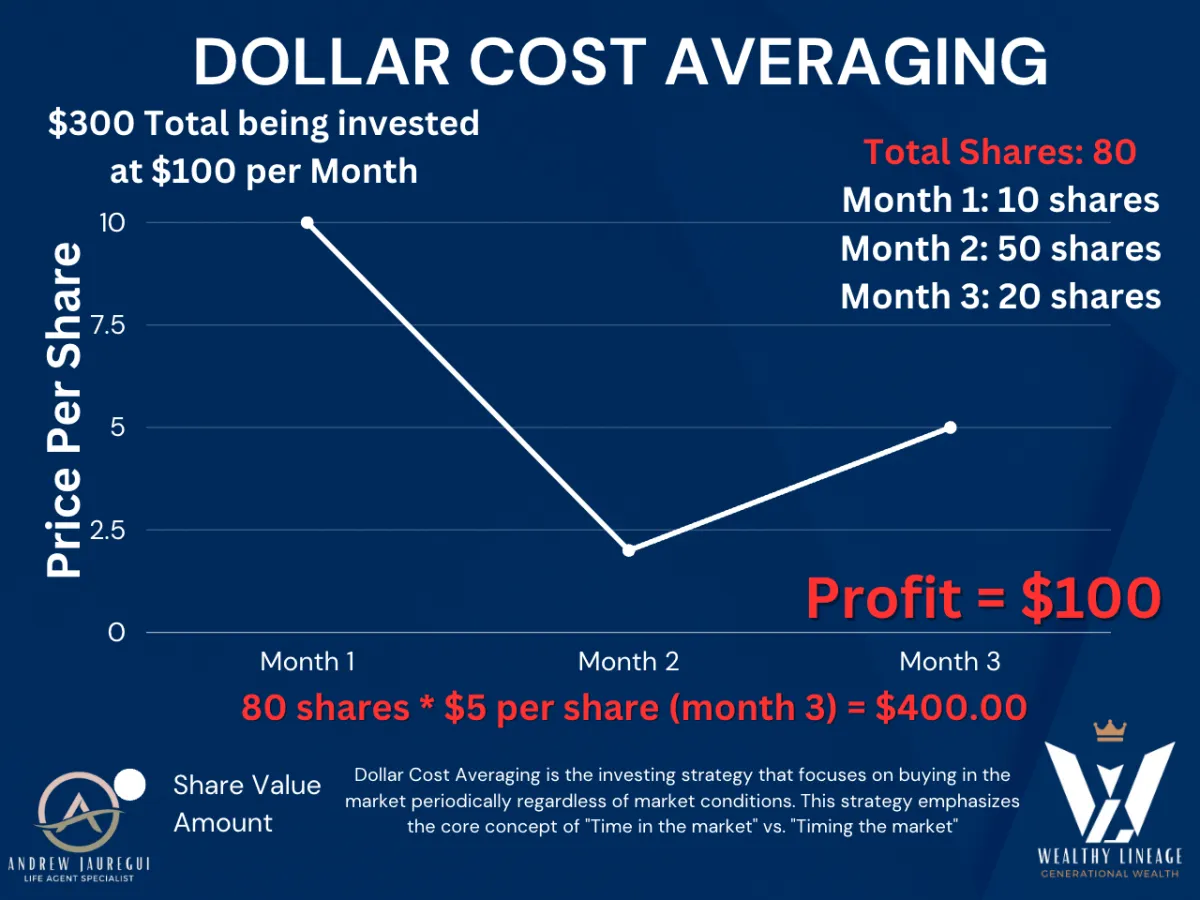

The Investing Strategy That Applies To ALL Industries!

How Long Will It Take You To Break The Debt Cycle?

Create Wealth For The Legacy You Leave Behind!

Andrew Jauregui Life Agent Specialist

Andrew Jauregui is an Independent Contractor and life insurance salesperson licensed by the state of California. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to accuracy of any description. All measurements and square footages are approximate. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of life insurance, real estate and/or financial services.