The ONLY Financial Team

That Puts What Matters To You First !

Growing and Leaving A Legacy Starts With You

See How We Provide The Best Custom Experience For Your Needs

Carriers.

Our Agency is designed to offer everything from fixed rate indexed annuities, IUL insurance policies, Term Policies, Whole Life, Final Expense and more!

Our team has established strong connections with DOZENS OF A-RATED Carriers That Provide Day One Coverage Along with Options to Grow A Legacy, Build a Legacy and Even Leave A Legacy.

Products.

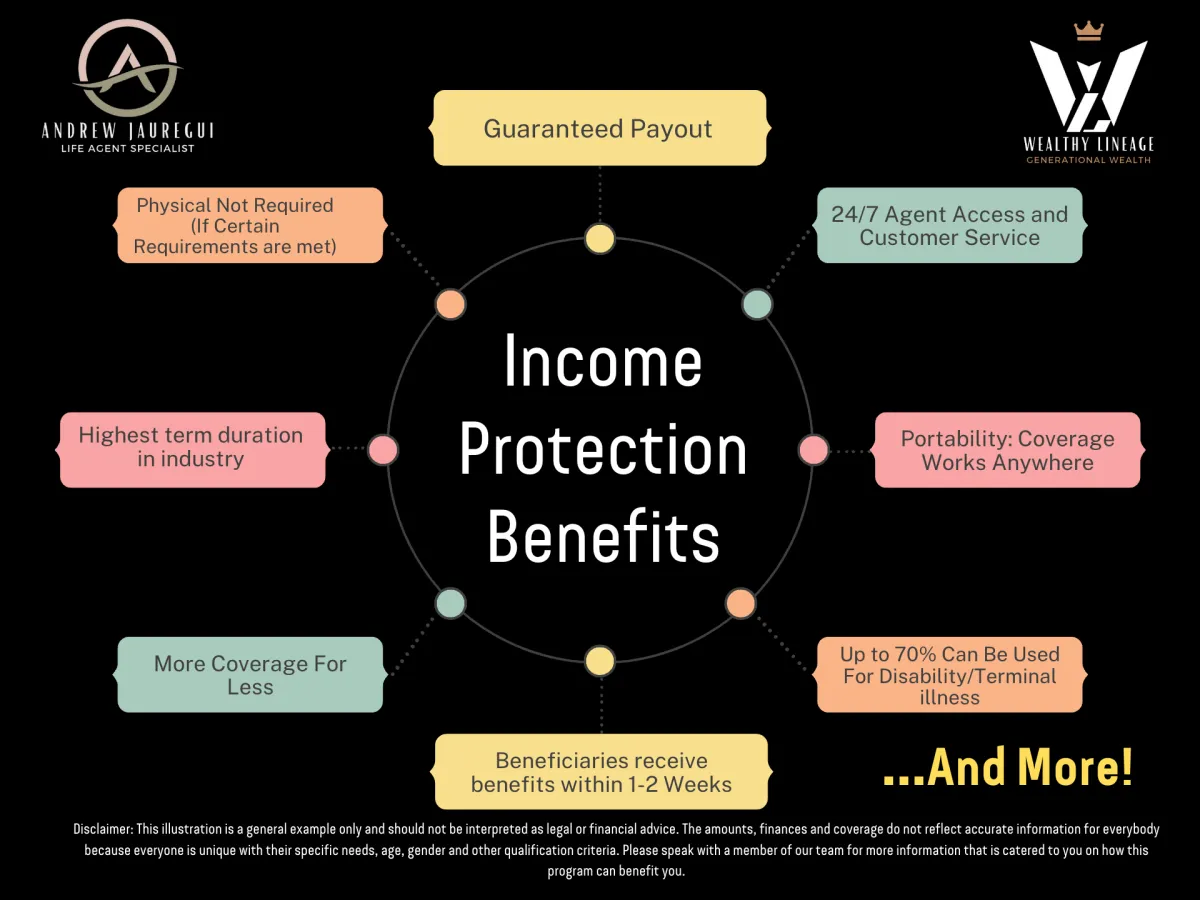

Final Expense Policies: Policies that have higher rates of approval designed with living benefits and same day coverage

Term Policies: Policies with 10,15,20, up to 30yr duration, portability benefits, and other exclusive features such as return of premium, terminal illness living benefits, non-smoking discount programs and more!

Whole Life Policies: Permanent policy with day one coverage, living benefits and a compounding Cash Value Account that can be accessed at any time

Indexed Universal Life Policies: Permanent Policy that builds equity with a cash value account that functions as a life insurance policy as well as the benefit of cash value account being indexed to to mimic the growth of S&P 500, The Global Economy with zero risk of loss.

Mortgage Protection Policies: Policies that are tied directly to your mortgage, provides day one coverage with living benefits and is meant to assist you and your family/loved ones cover the mortgage payment.

And More!

Meet The Founder

Andrew Jauregui

Andrew Jauregui is an independent life insurance broker and business consultant. He started his personal career in life insurance, real estate as well as marketing.

He began his entrepreneurial journey at the young age of 19 modeling after his parents who have created multiple successful businesses revolving around logistics.

Andrew knew he could carry on the legacy of serving others in his own way.

Andrew began his formal sales career training at the age of 18 within the fitness industry during his undergrad years of college and moved onto memberships sales at Costco, solar sales at Sunrun and finally Real Estate and Life Insurance sales for his own personal business.

Andrew Jauregui quickly understood the importance of knowing the product, the service but most importantly, understanding the client's wants and how to best serve them.

It's more than just being new, fresh or unique, it's about who cares the most and is capable of following through with what they said they'd do.

While no business is perfect, Andrew Jauregui has learned from many on his journey that the greatest gift you can provide a client aside from excellent service is honoring your word to the client, because their family is equally as important as your own.

Family: The Reason We All Work So Hard

This is How You Protect Your Family's Future and Loved Ones While You Work: Leaving A Legacy.

Our Programs Have The Ability to work for nearly everyone

Here's an example of the benefits our Term Income Protection Programs are able to offer with the select carriers we work with

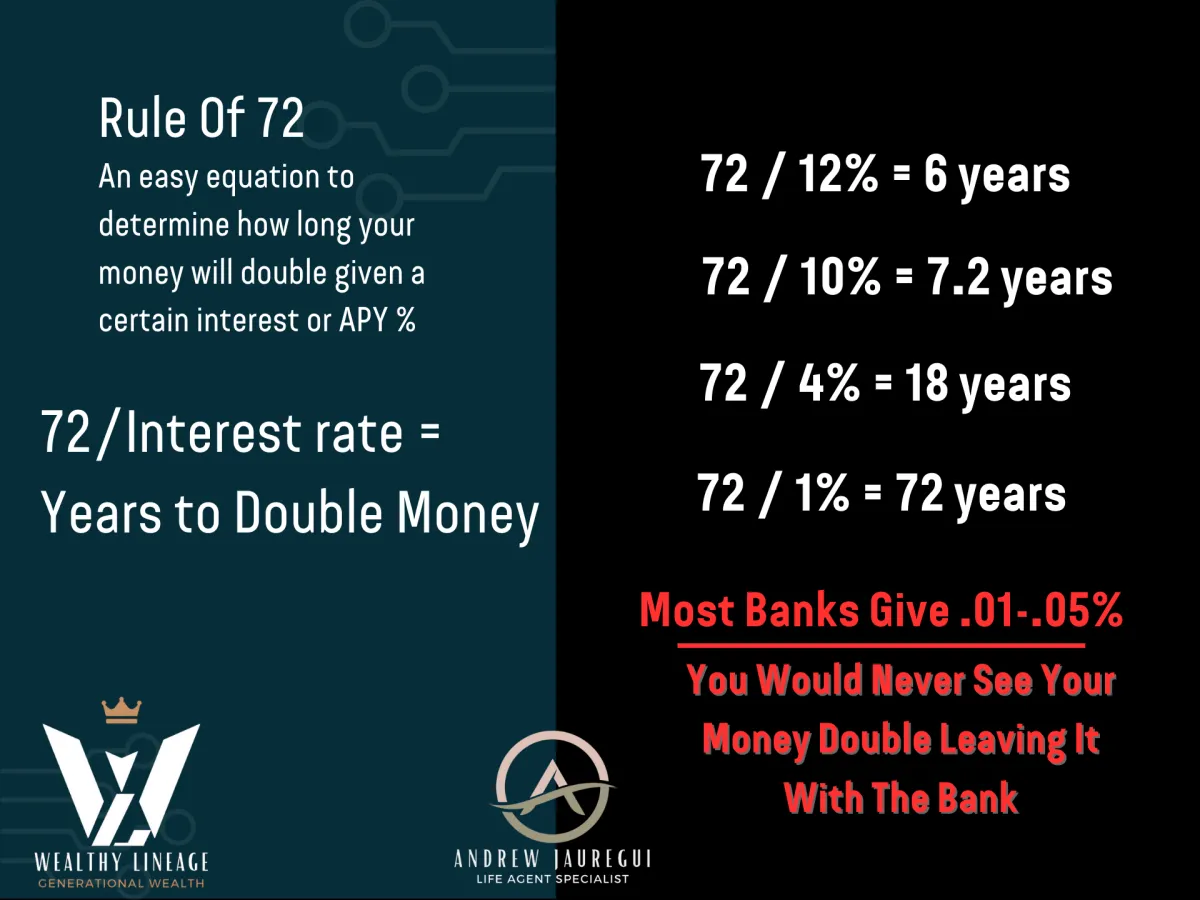

The Truth behind investing and saving your money with the bank. Money in their pocket is only for their benefit and does very little to your own financial growth.

Our Team

Wealthy Lineage Financial Group

is here to change that

Growing And Building A Legacy

You Don't Need To Wait To Start Your Wealth Journey

The Simple Secret to Wealth: Build it, grow it, and protect it.

Here’s how the rich stay rich: they buy income-producing assets and

protect their income at all costs.

What’s an asset? It’s anything that grows your wealth—whether it’s through cash flow, equity, tax benefits, or all three.

But here’s the catch: wealth-building isn’t just about playing offense.

To truly win, you need a rock-solid defense.

That’s where protective assets like insurance comes in.

It’s not just a safety net—it’s your family’s shield against financial setbacks like accidents, terminal illness, or loss.

Ready to secure your future? Let’s start building and protecting your wealth today!

How Long Would It Take You?

To Save 1 Million Dollars

To Save 500k Dollars

To Save 300k Dollars

To Fix Your Credit Score to 700+

To Grow Your Savings Leaving It in the Bank

To Retire Before the Age of 65?

To Retire Your Family, Your Parents, Your Kids

To Own Your House Instead Of Just Renting

Most People Avoid Asking These Questions UNTIL IT'S TOO LATE.

The Hard Truth:

Most People Will NEVER Be able to save their way to wealth

How Long Would It Take You To Break The Debt Cycle?

Create Wealth For The Legacy You Leave Behind!

Frequently Asked Questions

How Do I Apply?

Book a call by clicking one of the scheduling links and a licensed representative would be glad to assist you!

Is It Expensive?

All our income protection and policy plans are designed to match only what you need as well as what is financially sustainable for you! We are not in the business of assigning programs that clients don't need. That said, we do have the most competitive rates and programs in the insurance industry. Schedule a free consultation to find out for your specific needs!😃

How Do I Figure Out How Much Coverage I Need?

On your own it might be challenging to define what it is you truly need vs what you want. The truth is, life insurance needs may change throughout time as your goals change but our team of experts/licensed professionals are here to help you by providing a free financial needs analysis to give you better insight! Schedule a call with us to get your game plan started!🚀

Why Should I Apply Early?

Life insurance and income protection relies on underwriters of insurance companies to assess your health (which means a third-party will judge your current health, age, medical records if available, etc.) and cross-reference it with the statistics of the life span of your particular gender/age. What does that mean? It means someone who applies for a policy early in their 20s would get the same coverage of a 50yr old for WAY LESS. Also the odds of being approved at 20 are much greater than someone in their 50s. Again, everybody is unique and there are many factors involved but, the earlier you start the better your odds and the more you save.

How Do I Know I Need It?

We have insurance for everything in our day-to-day lives. In fact most items and products we utilize mandate and require it. You technically can't drive a car without auto-insurance and home-ownership also can require home-owners insurance (especially if in a flood-hazard zone, Fire Hazard Zone, etc.), so when it comes to life insurance...if you have unpaid debts (mortgage, cars, loans, companies, bills, student loans, credit card debt, funeral expenses, rainy day emergency, etc.) you and your family would definitely benefit from the tax-free life insurance to offset the financial burden.

Do I Need To Do Medical?

No! Most Of Our Carrier Partners Have Updated To Only Using Your Medical Information Record and basing your application approval off that. Other factors can definitely apply though such as requesting a high coverage amount that would require a fully underwritten medical check.

Are You Hiring?

Yes! Check out "Career Opportunities" Tab for more information on working with our team. If it seems like a great fit for you, our team would be happy to schedule an interview and walk you through onboarding.

Andrew Jauregui Life Insurance Broker

Andrew Jauregui is an Independent Contractor and life insurance broker. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to accuracy of any description. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of life insurance, real estate and/or financial services. Andrew Jauregui is an Independent Contractor and license

NPN#: 20522597